Unlock thousands in solar savings by discovering incentives specific to your zip code. From federal tax credits covering 30% of your installation costs to state-specific rebates and local utility company perks, your location determines exactly how much you can save on solar panels. Recent changes in solar legislation have created a complex web of financial incentives, with some homeowners saving up to $15,000 or more on their solar installation depending on where they live.

Smart homeowners know that solar incentives vary dramatically between neighborhoods, counties, and states. While the federal solar tax credit remains consistent nationwide, your zip code unlocks access to unique state rebates, property tax exemptions, and performance-based incentives that can multiply your savings. Some utility companies even offer additional cash bonuses or rate reductions for solar adoption in specific service areas.

Enter your zip code today to reveal every available solar incentive you qualify for – from government tax breaks to utility company rebates. With solar costs dropping 70% over the past decade and incentive programs constantly evolving, there’s never been a better time to explore how your location can maximize your solar savings.

Federal Solar Incentives Available Nationwide

The Federal Solar Tax Credit

The most significant solar incentive available nationwide is the federal solar tax credit, also known as the Investment Tax Credit (ITC). Currently set at 30% of your total solar installation costs, this incentive can save homeowners thousands of dollars on their solar investment. For a complete breakdown of eligibility and benefits, check out our comprehensive federal solar tax credit guide.

To qualify, you must own your solar system (rather than lease it) and have sufficient tax liability to claim the credit. The 30% credit applies to the total cost of your solar installation, including equipment, labor, and even battery storage systems when installed with solar panels. For example, if your solar installation costs $20,000, you could receive a $6,000 tax credit on your federal income taxes.

Thanks to the Inflation Reduction Act, this 30% credit will remain available through 2032, giving homeowners plenty of time to plan their solar investment. The credit can be claimed when you file your annual federal tax return, and if you can’t use the entire credit in one year, the remainder can be carried forward to future tax years.

Additional Federal Programs

Beyond the federal tax credit, several other nationwide programs can help make your solar installation more affordable. The USDA’s Rural Energy for America Program (REAP) offers grants and loan guarantees to agricultural producers and rural small businesses investing in renewable energy systems. The Modified Accelerated Cost Recovery System (MACRS) allows businesses to deduct the depreciation of solar equipment from their taxes over five years.

Homeowners can also take advantage of energy-efficient mortgages (EEMs) backed by the Federal Housing Administration or Veterans Affairs. These special mortgages help you finance energy-efficient improvements, including solar installations, as part of your home purchase or refinancing.

The Department of Energy’s Weatherization Assistance Program provides funding for energy-saving upgrades to low-income households, which can include solar installations in some cases. Additionally, some utility companies participate in federal energy efficiency programs that offer rebates for solar installations, though availability varies by region.

Remember to combine these federal programs with state and local incentives to maximize your savings on solar installation.

State-Specific Solar Incentives

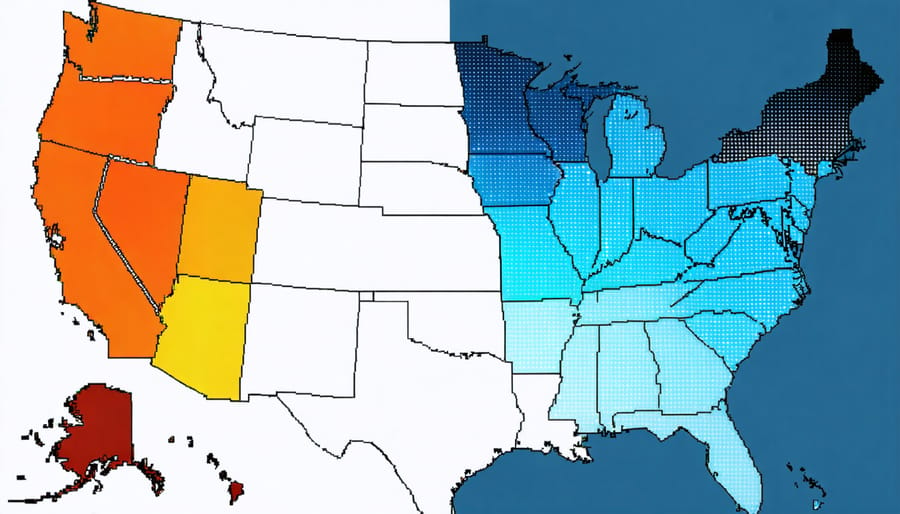

Top Solar-Friendly States

Several states have emerged as leaders in supporting solar adoption through generous state solar incentives and progressive policies. California continues to lead the pack with its robust Solar Rights Act and generous rebate programs. The Golden State’s net metering policies allow homeowners to earn substantial credits for excess energy production.

New Jersey stands out with its SREC (Solar Renewable Energy Certificate) program, enabling residents to earn additional income from their solar systems. Massachusetts offers both direct incentives and a strong SMART program, making solar installations significantly more affordable for homeowners.

Rhode Island and Connecticut provide attractive combination packages of tax exemptions, rebates, and performance-based incentives. New York’s NY-Sun initiative has made solar increasingly accessible through declining block grants and tax credits.

Maryland’s Clean Energy Grant Program offers direct payments to homeowners installing solar systems, while Oregon’s solar + storage rebate program helps residents maximize their energy independence.

These states consistently demonstrate their commitment to renewable energy through comprehensive incentive packages, making solar adoption more financially viable for homeowners. However, it’s important to note that incentive programs are regularly updated, and availability may vary based on funding levels and program deadlines. Checking current offerings in your specific location is essential for making informed decisions about solar installation.

State Tax Credits and Rebates

Many states offer substantial tax credits and rebates to encourage solar adoption, with some featuring particularly generous solar incentive programs that can significantly reduce your installation costs. These state-level incentives typically come in several forms:

Direct rebates provide immediate savings on your solar installation, with some states offering thousands of dollars back based on system size or total cost. Tax credits work similarly to the federal tax credit but at the state level, allowing you to deduct a percentage of your solar costs from your state tax bill.

Performance-based incentives (PBIs) reward you for the actual electricity your system produces, often through Solar Renewable Energy Credits (SRECs). These credits can be sold for additional income, making your solar investment even more valuable.

Property tax exemptions ensure your home’s value increase from solar panels won’t raise your property taxes, while sales tax exemptions eliminate state sales tax on your solar purchase. Some states also offer low-interest loan programs specifically for solar installations.

The value and availability of these incentives vary significantly by state and can change over time, making it essential to check current offerings in your area. Working with a local solar installer can help you identify and maximize all available state incentives.

Local Utility and Municipal Programs

Net Metering Programs

Net metering is one of the most valuable solar incentives available to homeowners, allowing you to earn credits on your electricity bill for excess power your solar panels generate. When your system produces more electricity than you’re using, that surplus energy flows back into the grid, essentially running your meter backward.

The specific terms of net metering programs vary by utility company and location. Most utilities offer a 1:1 credit, meaning you’ll receive the full retail rate for each kilowatt-hour of excess electricity your system produces. Some utilities may offer slightly different rates or have monthly rollover policies for unused credits.

To find out what net metering benefits are available in your area, check with your local utility provider. Many utilities list their net metering policies online or have dedicated solar departments to help customers understand their programs. Keep in mind that net metering policies can change, so it’s important to verify current terms when planning your solar installation.

The financial impact of net metering can be substantial. During peak production months, many solar homeowners generate enough excess electricity to offset their nighttime usage and even earn credits that carry over to less sunny months. This helps maximize your solar investment and can significantly reduce or eliminate your annual electricity costs.

Municipal Solar Rebates

Many cities across the United States offer their own solar rebate programs, making solar installations even more affordable for local residents. These municipal incentives often come in the form of direct rebates, property tax exemptions, or expedited permit processing, and they can vary significantly from one city to another.

To find local solar rebates in your area, start by checking your city’s official website, particularly the sustainability or energy departments. Many municipalities partner with local utilities to provide additional incentives beyond state and federal programs. For example, some cities offer per-watt rebates that can range from $0.20 to $1.00 per watt installed, potentially saving homeowners thousands of dollars.

Notable city programs include Austin Energy’s solar rebate program, which offers up to $2,500 for residential installations, and San Francisco’s GoSolarSF program, which provides extra incentives for low-income households. Some cities also offer innovative financing options like Property Assessed Clean Energy (PACE) programs, allowing homeowners to finance solar installations through their property taxes.

The best way to discover available municipal incentives is to:

– Contact your city’s sustainability office

– Consult local solar installers familiar with area programs

– Check your municipal utility company’s website

– Review the Database of State Incentives for Renewables & Efficiency (DSIRE)

– Attend local renewable energy workshops or seminars

Remember that municipal incentives often have limited funding and may operate on a first-come, first-served basis, so timing your solar project strategically can help maximize your savings.

How to Find Your Local Solar Incentives

Using Online Solar Incentive Databases

Several user-friendly online databases make finding solar incentives in your area straightforward and hassle-free. The Database of State Incentives for Renewables & Efficiency (DSIRE) stands out as one of the most comprehensive resources, offering detailed information about available solar energy grants, tax credits, and rebates searchable by zip code.

Another valuable tool is EnergySage’s Solar Incentive Calculator, which provides personalized estimates of available incentives based on your location and energy usage patterns. The Department of Energy’s website also maintains an updated database of federal incentives and connects homeowners with state-specific resources.

Local utility company websites often feature dedicated solar incentive pages where you can find information about net metering programs and utility-specific rebates. Many of these sites offer interactive tools that help you calculate potential savings based on your exact location and energy consumption.

For the most accurate and current information, consider using multiple databases to cross-reference available incentives. Remember that these online resources are regularly updated to reflect changes in incentive programs, but it’s always wise to verify the information with local authorities or solar installers.

Pro tip: Set up email alerts on these platforms to stay informed about new incentives or changes to existing programs in your area. Many databases offer this feature, helping you catch time-sensitive opportunities that could maximize your solar investment.

Working with Local Solar Installers

Local solar installers are valuable partners in your solar journey, offering more than just installation services. These professionals stay up-to-date with the latest incentive programs and can help you identify and secure all available rebates and tax credits in your area.

Experienced installers often have established relationships with local utilities and government agencies, making the paperwork process smoother and more efficient. They can guide you through application procedures, deadlines, and specific requirements for each incentive program, ensuring you don’t miss out on any potential savings.

Many installers also offer free consultations where they assess your property’s solar potential and create customized proposals that factor in available incentives. This helps you understand the true cost of going solar after accounting for all possible rebates and tax breaks. Some installers even handle the incentive paperwork on your behalf, saving you time and reducing the chance of errors that could delay or disqualify your applications.

Additionally, local installers are familiar with city-specific building codes, permit requirements, and utility interconnection processes. This knowledge is crucial for ensuring your solar installation qualifies for available incentives, as some programs have specific equipment or installation requirements.

To maximize your benefits, consider getting quotes from multiple local installers. Each may have different approaches to leveraging incentives or relationships with specific manufacturers offering additional rebates. Compare their proposals carefully, paying attention to how they structure the incentives and their timeline for claiming them.

Remember to ask potential installers about their experience with local incentive programs and their success rate in securing benefits for previous customers. This information can help you choose an installer who will effectively advocate for your financial interests.

Taking advantage of solar incentives in your area can significantly reduce the cost of going solar while contributing to a more sustainable future. By researching and understanding the available incentives specific to your zip code, you can maximize your savings and make an informed decision about solar installation.

Remember that solar incentives vary widely by location and can change over time. Federal tax credits provide a strong foundation, but state, local, and utility-specific incentives can often double or triple your total savings. Don’t miss out on these opportunities by waiting too long – many incentive programs have limited funding or decreasing benefit scales.

To get started, gather your zip code and recent energy bills, then connect with local solar providers who can help you navigate available incentives. Many offer free consultations and can provide detailed estimates of your potential savings. Take advantage of online solar calculators and incentive databases to get a preliminary understanding of what’s available in your area.

The transition to solar energy has never been more accessible or financially attractive. With the right combination of incentives, you could significantly reduce your upfront costs while securing long-term energy savings. Take action today to explore the solar incentives available in your zip code and join the growing community of homeowners embracing clean, renewable energy.