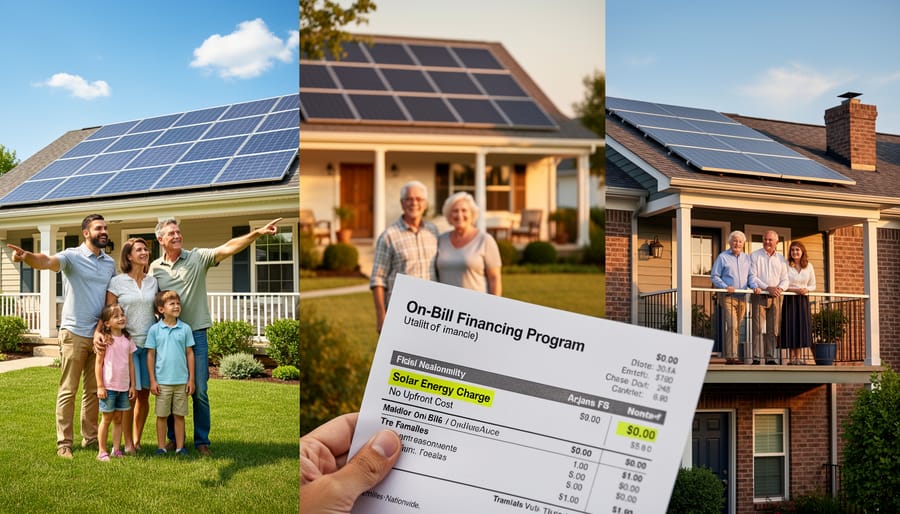

Solar energy doesn’t have to drain your savings account. On-bill financing revolutionizes how homeowners go solar by eliminating the barrier of upfront solar costs and transforming the payment process into something beautifully simple: you pay for your solar system directly through your monthly utility bill.

Think of it as spreading your investment over time while immediately enjoying lower energy costs. The genius of this approach lies in its flexibility—instead of draining your bank account or taking on traditional loans with complex terms, you simply see an additional line item on your existing utility bill. Many homeowners discover their monthly solar payment plus reduced energy charges actually cost less than their old electricity bills alone.

This financing method removes the intimidation factor from going solar. No need to navigate complicated loan applications or worry about equity requirements. You’re not just investing in clean energy; you’re accessing a payment structure designed specifically to make renewable energy achievable for everyday homeowners who value both environmental responsibility and financial common sense.

What Is On-Bill Financing for Solar?

On-bill financing is a payment option that lets you go solar without the burden of a large upfront investment. Instead of taking out a traditional loan or paying thousands of dollars at once, you simply add your solar system payments to your regular utility bill. Think of it as a seamless way to transition to clean energy while keeping your finances manageable.

Here’s how it works: Your local utility company or a partnering lender covers the cost of installing your solar panels. Once your system is up and running, you make monthly payments through your existing utility bill, just like you always have. The beauty of this arrangement is that your solar savings often offset these payments, so you’re essentially swapping your old electric bill for a predictable payment that includes your solar investment.

What makes on-bill financing different from traditional solar loans? The key distinction is convenience and simplicity. You don’t need to set up a separate loan account, remember another due date, or deal with multiple companies. Everything appears on one familiar bill you’re already paying each month. Additionally, many on-bill programs feature competitive interest rates and flexible terms designed specifically for renewable energy projects.

Another significant advantage is that on-bill financing typically requires less stringent credit requirements than conventional loans, making solar accessible to more homeowners. The financing is often tied to the property’s utility meter rather than to you personally, which can simplify the process if you decide to sell your home.

This approach removes the financial barriers that have traditionally kept homeowners from making the switch to solar, turning what once seemed like an impossible investment into an achievable monthly expense.

How On-Bill Solar Financing Actually Works

The Application and Approval Process

Getting started with on-bill financing is refreshingly straightforward. Most programs require basic documentation: proof of homeownership, recent utility bills, and property information. Unlike traditional loans, there’s typically no formal credit check since the financing is tied to your property’s meter, not your personal credit score. This is great news if you’ve been worried about credit requirements standing in your way.

Approval criteria focus on practical factors rather than financial history. Your utility company will verify you’re current on your bills and that your property is eligible for the improvements offered through the program. Some programs require that your account has been in good standing for six to twelve months.

The timeline is typically faster than conventional financing. After submitting your application, you can often expect approval within one to three weeks. Once approved, a certified contractor will assess your home and recommend specific improvements. Installation scheduling depends on contractor availability and project scope, but many homeowners complete the entire process from application to installation within two to three months. The beauty of this system is its simplicity—your utility company handles most of the heavy lifting, making energy-efficient upgrades more accessible than ever before.

Installation and Payment Setup

Once you’ve chosen on-bill financing, the installation process is straightforward and similar to traditional solar installations. Your approved contractor will schedule the work at your convenience, typically completing the installation within one to three days depending on system size. You won’t need to pay anything upfront or arrange complicated loan paperwork before the panels go up.

After installation, here’s where on-bill financing really shines in simplicity. Your monthly payment appears as a line item directly on your regular utility bill, right alongside your electricity charges. There’s no separate loan payment to remember or additional creditor to manage. You’ll see your reduced energy costs from solar production and the financing charge all in one place, making it easy to track your actual savings.

The payment amount stays consistent each month, so you can budget confidently without surprises. Many homeowners find their total bill including the financing charge is still lower than what they paid before going solar. This seamless payment structure eliminates the hassle of juggling multiple accounts while you enjoy clean energy and lower overall costs.

The Difference Between On-Bill Financing and Tariffed-On-Bill Programs

Though these terms sound similar, they work quite differently, and understanding the distinction can help you choose the right option for your situation.

On-bill financing is essentially a loan. Your utility company partners with a lender to offer you financing for energy improvements like solar panels. You receive the funds, complete your installation, and then repay the loan through charges added to your monthly utility bill. It’s convenient because everything appears on one bill, but the loan is attached to you personally. If you move, you’ll need to pay off the remaining balance or transfer the loan obligation.

Tariffed-on-bill programs work differently. Instead of a traditional loan, you’re agreeing to pay a tariff or charge that stays with your property, not with you personally. Think of it like a property tax assessment. The key advantage here is transferability: when you sell your home, the payment obligation typically transfers to the new owner along with the solar system and its benefits. This can actually make your home more attractive to buyers since they inherit both the clean energy system and the payment structure.

The main takeaway? On-bill financing follows you, while tariffed-on-bill programs stay with the property. Both make solar accessible without large upfront costs, but tariffed programs offer more flexibility if you’re planning to move within the next several years. Your local utility’s available programs will determine which option you can access.

Real Benefits That Make On-Bill Financing Worth Considering

No Money Down Means Solar Today, Not Years From Now

The biggest barrier to solar adoption isn’t the technology or installation complexity—it’s waiting to save enough money for the upfront investment. Traditional solar purchases can require $15,000 to $30,000 before panels ever touch your roof. Even with traditional loans, many homeowners face down payments and credit checks that delay their solar dreams by years.

On-bill financing changes this timeline completely. Because the solar system technically belongs to the utility program until you’ve paid it off through your electric bill, there’s no massive upfront payment standing between you and clean energy. You can start generating your own power and reducing your monthly costs within weeks of approval, not years down the road. For families who’ve been putting off solar because they’re saving for other priorities—education, home repairs, or retirement—this financing structure means you don’t have to choose. Your solar journey begins today, and your savings start accumulating immediately.

Your Monthly Payment Often Costs Less Than Energy Savings

Here’s the reality that surprises most homeowners: your monthly payment for energy improvements typically costs less than what you’ll save on your electricity bill. This means you could see immediate positive cash flow from day one.

Let’s say your energy-efficient upgrades reduce your monthly electric bill by $85. If your on-bill financing payment is only $70 per month, you’re actually $15 ahead every single month. You’re enjoying a more comfortable, energy-efficient home while keeping extra money in your pocket.

This happens because the improvements you’re financing directly reduce your energy consumption. Better insulation, efficient HVAC systems, or solar panels mean you’re using less electricity. The utility company calculates your loan payment to align with these anticipated savings, ensuring you don’t pay more overall.

The best part? You don’t need to wait years to benefit. Unlike traditional home improvements where you hope to recoup costs eventually, on-bill financing creates value immediately. Your reduced energy consumption starts offsetting payments right away, making sustainable living financially accessible today.

Simpler Than Traditional Solar Loans

On-bill financing removes much of the hassle that comes with traditional solar loans. Instead of managing separate loan payments, credit checks, and paperwork through multiple lenders, you’ll simply see the charges appear on your existing utility bill. It’s a payment method you already know and trust.

The process is remarkably straightforward. Your solar provider handles most of the administrative work, and since the financing is tied to your property’s meter rather than your personal credit, approval is often faster and easier. You won’t need to remember another payment deadline or set up another account. The charge automatically integrates with your monthly utility bill, making budgeting simpler. This convenience factor appeals to busy homeowners who want solar energy without adding complexity to their financial lives. Plus, if questions arise, you’re working with familiar utility company systems rather than navigating unfamiliar lending institutions.

What Happens If You Sell Your Home?

One of the most common concerns about on-bill financing is what happens when you decide to sell your home. The good news? It’s typically much simpler than you might think.

With on-bill financing, the loan stays with the property, not with you personally. This means when you sell your home, the financing obligation transfers to the new homeowner along with the energy upgrades. They’ll continue making the monthly payments through their utility bill, just as you did. Think of it like a property tax assessment that passes naturally from one owner to the next.

Here’s why this setup actually works in your favor: energy-efficient homes are more attractive to buyers. Your solar panels or other improvements increase your property value, and since the payments are typically lower than the energy savings, the new owner immediately benefits from reduced overall costs. You’re selling them a home that pays for itself.

Let’s debunk a common myth: on-bill financing won’t complicate your home sale or scare away buyers. Real estate professionals are increasingly familiar with this financing model, and disclosure requirements are straightforward. The transfer process is usually handled seamlessly through standard closing procedures.

Another myth worth busting: you won’t need to pay off the entire balance before selling. Unlike some home improvement loans that require full repayment at sale, on-bill financing is designed specifically to transfer with the property.

The bottom line? Selling your home with on-bill financing is hassle-free, and your energy improvements become a selling point rather than a concern.

Is On-Bill Financing Available in Your Area?

On-bill financing isn’t available everywhere yet, but it’s expanding rapidly as more utilities recognize its value. Availability depends primarily on your local utility company and state regulations. Some areas have robust programs, while others are still developing their offerings.

To find out if on-bill financing is available in your area, start by contacting your utility provider directly. Most utilities list their energy efficiency and renewable energy programs on their websites. You can also check with your state’s energy office or public utility commission for a comprehensive list of available programs.

If on-bill financing isn’t currently offered where you live, don’t lose hope. Several alternative financing options can make solar accessible, including traditional solar loans, home equity lines of credit, and property assessed clean energy programs. Many solar installers also offer in-house financing with competitive rates.

The good news? On-bill programs continue to launch in new areas as utilities see their success in reducing energy consumption and helping customers go solar. Even if it’s not available today, it might be soon in your community.

Common Myths About On-Bill Solar Financing

Let’s clear up some common misconceptions that might be holding you back from exploring on-bill solar financing.

One prevalent myth is that you need perfect credit to qualify. While traditional solar loans often require excellent credit scores, on-bill financing programs typically have more flexible requirements. Many programs focus on your payment history with your utility rather than your credit score, making solar accessible to more homeowners.

Another misunderstanding is that on-bill financing will complicate selling your home. Actually, since the payment obligation stays with the property’s utility meter rather than following you personally, it often transfers seamlessly to the new owner. Many buyers appreciate inheriting a home with lower energy costs already built into the utility bill.

Some people worry that on-bill programs are too good to be true or hide expensive fees. In reality, these programs are often backed by utilities or government initiatives designed specifically to accelerate solar adoption. The terms are typically transparent, and many programs offer competitive rates because they’re structured to benefit both homeowners and the broader energy grid.

Finally, there’s a misconception that the approval process is complicated and time-consuming. Most on-bill financing applications are straightforward, often requiring less paperwork than traditional loans. The streamlined process means you can move forward with your solar installation faster, starting to enjoy savings sooner than you might expect.

On-bill financing breaks down the biggest barrier standing between you and solar energy: upfront costs. Instead of worrying about how to fund your clean energy transition, you can start saving money and reducing your carbon footprint immediately. Your solar investment pays for itself through the energy savings on your monthly utility bill, making sustainable living more accessible than ever before.

If you’ve been hesitant about paying for solar panels, this financing option deserves your attention. With no credit checks, no upfront payments, and immediate savings, there’s little reason to delay. The path to lower energy bills and a greener home is clearer than you might think. Take the next step today by exploring on-bill financing programs available in your area and join the growing community of homeowners who’ve made the switch to solar without financial stress.