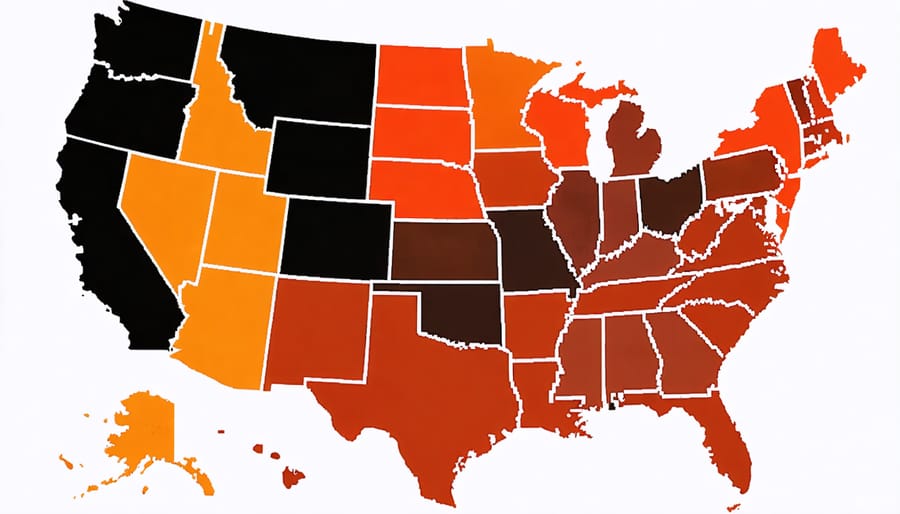

Maximize your business’s solar investment potential by leveraging the diverse incentives available across U.S. states. As commercial solar adoption continues to surge, state governments are offering increasingly competitive financial incentives, tax breaks, and performance-based rewards to businesses making the switch to solar energy.

From California’s generous Self-Generation Incentive Program (SGIP) to New York’s NY-Sun Initiative, each state provides unique opportunities to significantly reduce installation costs and accelerate ROI. Combined with the federal Investment Tax Credit (ITC) of 30%, these state-specific programs can offset up to 50-75% of your total solar investment costs.

Understanding these varied incentive landscapes is crucial for making informed decisions about commercial solar installations. While some states focus on upfront rebates, others emphasize performance-based incentives or favorable net metering policies. This comprehensive guide breaks down the available incentives state by state, helping you identify and capitalize on every available opportunity to maximize your solar investment’s financial returns.

Federal Solar Investment Tax Credit (ITC): The Foundation

The foundation of commercial solar incentives starts with the Federal Solar Investment Tax Credit (ITC), a powerful financial tool that serves as the cornerstone for businesses considering solar adoption. This federal incentive allows commercial property owners to claim substantial solar tax credits against their federal tax liability.

As of 2024, the ITC provides a 30% tax credit on the total cost of installing a solar energy system, with no cap on its value. This means that for every $100,000 invested in solar installation, businesses can receive $30,000 back through reduced federal taxes. The credit covers not only the solar panels themselves but also installation costs, mounting equipment, and other balance-of-system components.

What makes the ITC particularly attractive is its compatibility with state and local incentives. Businesses can stack these benefits, potentially reducing their overall solar investment by 50% or more when combined with state-specific programs. The credit can be carried forward for up to 20 years if the tax liability in the installation year isn’t sufficient to claim the full amount.

Additionally, businesses can take advantage of bonus depreciation rules, allowing them to deduct a significant portion of the solar investment in the first year. This accelerated depreciation, combined with the ITC, creates a powerful financial incentive that dramatically improves the return on investment for commercial solar installations.

Understanding the ITC is crucial as it forms the baseline upon which all other state incentives are built, making solar energy an increasingly attractive investment for businesses across the country.

Top State Solar Incentive Programs

California: Leading the Solar Revolution

California continues to lead the nation in solar adoption, offering some of the most generous commercial solar incentives in the country. The state’s Self-Generation Incentive Program (SGIP) provides substantial rebates for businesses installing solar-plus-storage systems, with higher incentives available for projects in high-fire-threat districts.

The California Solar Initiative (CSI) Performance-Based Incentive program rewards businesses based on their system’s actual performance, encouraging optimal installation and maintenance practices. Additionally, property owners can take advantage of property tax exclusions for solar energy systems through 2024, significantly reducing the overall cost of installation.

Local utilities throughout California offer their own incentive programs. For example, the Sacramento Municipal Utility District (SMUD) provides commercial solar rebates up to $0.20 per watt, while Los Angeles businesses can benefit from the LADWP Solar Incentive Program.

The state also mandates net metering policies, allowing businesses to earn credits for excess power generated and sent back to the grid. Combined with federal incentives, these programs can help businesses recover up to 70% of their initial solar investment.

New York: NYSERDA and Beyond

New York stands out as a leader in commercial solar incentives, with NYSERDA (New York State Energy Research and Development Authority) offering substantial support for businesses going solar. The NY-Sun program provides direct incentives that can significantly reduce initial installation costs, with rates varying by region and system size.

Businesses can benefit from the state’s generous tax incentives, including a 25% tax credit capped at $5,000 and property tax exemptions for solar installations. The Commercial and Industrial Performance Program (CIPP) offers performance-based incentives that reward energy efficiency improvements alongside solar installations.

New York City properties can access additional benefits through the NYC Property Tax Abatement, which provides a 4-year tax break worth up to 20% of solar installation costs. The state’s community solar programs allow businesses to participate in shared solar projects, making solar accessible even for properties without suitable roof space.

NYSERDA also provides low-interest financing options and technical assistance to help businesses navigate the solar installation process, making New York one of the most solar-friendly states for commercial properties.

Massachusetts: SMART Program Benefits

Massachusetts leads the way in solar incentives through its SMART (Solar Massachusetts Renewable Target) Program, offering exceptional benefits for commercial solar installations. The program provides fixed monthly payments based on system size and location, with rates typically ranging from $0.14 to $0.26 per kilowatt-hour produced. These payments continue for 20 years, creating a predictable revenue stream for businesses. The program also offers additional incentives for energy storage integration and installations in preferred locations. Businesses can stack these benefits with federal tax credits and accelerated depreciation, making Massachusetts one of the most financially attractive states for commercial solar investment. The SMART Program’s declining block structure means early adopters receive the highest incentive rates, encouraging swift action for maximum returns.

Local Government Support Programs

Beyond state-level incentives, many local governments offer additional support to make commercial solar installations more affordable and attractive. These local incentive programs can significantly reduce your overall investment costs when combined with state and federal benefits.

Cities and counties across the country provide various forms of support, including property tax exemptions, streamlined permitting processes, and direct cash rebates. For example, some municipalities offer reduced permit fees or expedited review processes for commercial solar installations, saving both time and money during the project development phase.

Many local utilities also participate in these initiatives through performance-based incentives, which reward businesses based on the actual energy their solar systems produce. Some notable programs include:

– Performance-based rebates that pay per kilowatt-hour generated

– Zero-interest loan programs for commercial solar installations

– Green building incentives that include solar as a qualifying improvement

– Local grant programs for businesses transitioning to renewable energy

– Special assessment districts that finance solar through property taxes

To maximize your benefits, it’s essential to research both your city and county programs, as these can often be combined. Many local governments also offer additional incentives for businesses in specific zones or industries, particularly those focused on sustainable development or manufacturing.

Remember that local programs often have limited funding and may operate on a first-come, first-served basis. Working with a qualified solar installer familiar with your area’s specific programs can help ensure you don’t miss out on available benefits. They can also help you navigate the application process and maximize your combined incentives across all government levels.

How to Maximize Your Solar Savings

Timing Your Solar Installation

Strategic timing can significantly impact the value of your commercial solar investment. Many state incentives operate on a first-come, first-served basis, with funding cycles typically beginning in January or July. To maximize your benefits, start planning your installation 3-4 months before these cycles begin, allowing time for paperwork and approvals. Keep track of current solar policy developments as incentive programs may change annually.

The federal Investment Tax Credit (ITC) doesn’t have seasonal restrictions, but your fiscal year timing matters for optimal tax benefits. Consider scheduling your installation completion to align with your business’s tax strategy. Many utilities offer additional incentives during off-peak installation seasons, typically fall and winter, when contractor availability is higher and rates may be lower.

For performance-based incentives, summer installations can start generating returns faster due to longer daylight hours. However, winter installations often come with shorter wait times and potentially better pricing from installers. Remember to check application deadlines for state-specific programs, as some require pre-approval before installation begins.

Documentation Requirements

To qualify for commercial solar incentives, you’ll need to prepare several essential documents. Start with your business tax returns and proof of property ownership or lease agreement. Most programs require recent utility bills to verify your energy consumption patterns and a detailed proposal from your certified solar installer.

Keep copies of all equipment specifications and warranties, as these are often necessary for both federal and state incentive applications. You’ll also need to obtain proper building permits and documentation of your system’s compliance with local zoning laws and building codes.

Many states require an energy audit before approval, so schedule this early in the process. Documentation of your business structure (LLC, corporation, etc.) and proof of good standing with state authorities are typically necessary. Some programs also ask for financial projections showing how the solar installation will impact your business operations.

Remember to maintain detailed records of all installation costs, including equipment purchases and labor expenses, as these will be crucial for tax credit applications and grant programs.

The landscape of commercial solar incentives across the United States presents unprecedented opportunities for businesses to embrace sustainable energy while securing significant financial benefits. From federal tax credits and state-specific rebates to local utility incentives, the combined savings can substantially reduce the initial investment in solar installations and accelerate your return on investment.

By taking advantage of these diverse incentive programs, businesses can typically recover 50-80% of their solar installation costs through various rebates, tax benefits, and grants. The combination of reduced energy bills, protection against rising utility rates, and positive environmental impact makes commercial solar an increasingly attractive investment for forward-thinking businesses.

Don’t let these valuable opportunities slip away. Many state-specific incentives operate on a first-come, first-served basis, and some programs have limited funding or declining benefit schedules. The time to act is now, while the most favorable incentives are still available.

Consider consulting with a qualified solar installer or energy consultant who can help navigate the complex landscape of available incentives in your state. They can provide a detailed analysis of potential savings and guide you through the application process for various programs.

By investing in solar energy today, you’re not just making a smart financial decision – you’re positioning your business as an environmental leader while securing long-term energy independence and cost stability for years to come.