Transform your home into an energy-efficient powerhouse while maximizing government incentives through smart renewable energy choices. Federal tax credits now cover up to 30% of solar installation costs, while state-level programs offer additional rebates ranging from $2,000 to $6,000 for qualifying households. Combined with net metering policies that let homeowners sell excess power back to the grid, these incentives can reduce payback periods to just 5-7 years. Local utilities further sweeten the deal through performance-based incentives, offering ongoing payments for clean energy production. Whether you’re considering rooftop solar panels, energy storage systems, or other green upgrades, understanding and leveraging these financial benefits makes sustainable living more accessible than ever. Recent policy changes have made 2024 an ideal time to invest in home renewable energy, with expanded incentive programs and simplified application processes designed to help homeowners transition to clean power while protecting their wallets.

Federal Tax Credits That Put Money Back in Your Pocket

The Solar Investment Tax Credit Explained

The Solar Investment Tax Credit (ITC) stands as one of the most significant financial incentives for homeowners investing in solar energy. This federal tax credit allows you to deduct 30% of your total solar installation costs from your federal taxes, making solar power more affordable than ever.

Here’s how it works: If you install a solar system costing $20,000, you can claim $6,000 (30% of the total cost) as a tax credit. Unlike a deduction, a tax credit reduces your tax bill dollar-for-dollar. If you owe $7,000 in federal taxes, applying this $6,000 credit would reduce your tax bill to just $1,000.

The ITC covers not just the panels, but also installation costs, equipment, and even battery storage systems when installed with solar panels. To qualify, you must own your solar system (rather than lease it), and it must be installed at your primary or secondary residence in the United States.

The 30% credit rate is guaranteed through 2032, after which it will decrease to 26% in 2033 and 22% in 2034. To maximize your benefit, keep all receipts and documentation related to your solar installation, and consult with a tax professional about claiming the credit on IRS Form 5695.

Remember, the ITC can be combined with state and local incentives, potentially making your transition to solar even more affordable.

Additional Federal Energy Efficiency Programs

Beyond the primary tax credits, the federal government offers several additional programs to help homeowners embrace energy efficiency. The Weatherization Assistance Program (WAP) provides free home energy upgrades to low-income households, including insulation improvements, HVAC system repairs, and air sealing services.

The Energy Efficient Mortgages (EEM) program allows homebuyers to finance energy-efficient improvements as part of their home purchase or refinancing. This program enables you to roll the costs of energy upgrades into your mortgage, often with better terms than separate financing options.

The Department of Energy’s Home Energy Score program provides a standardized assessment of your home’s energy efficiency, helping you identify the most impactful improvements. Many utility companies partner with this program to offer additional rebates and incentives.

Rural homeowners can access the Rural Energy for America Program (REAP), which provides grants and loan guarantees for renewable energy systems and energy efficiency improvements. The program covers up to 25% of project costs through grants and up to 75% through loan guarantees.

These federal programs often work in conjunction with state and local incentives, multiplying your potential savings. Many also offer special provisions for seniors, veterans, and low-income households, making green energy improvements more accessible to all Americans.

State and Local Incentives in Your Area

State Tax Credits and Rebates

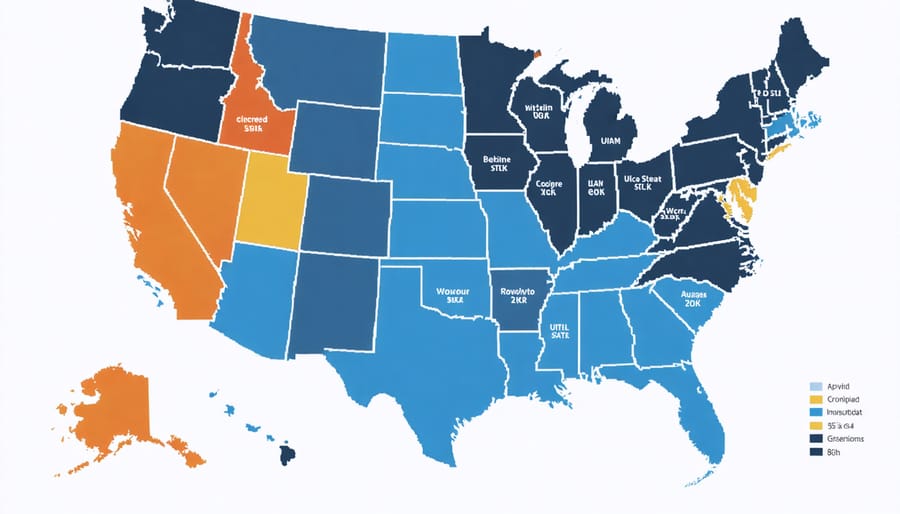

Beyond federal incentives, many states offer generous tax credits and rebates that can significantly reduce your green energy investment costs. These state-level incentives vary widely, with some states offering thousands of dollars in additional savings through tax credits, rebates, and performance-based incentives.

California leads the way with its Self-Generation Incentive Program (SGIP), providing rebates for solar battery storage systems. New York offers the NY-Sun program, which can cover up to 25% of your solar installation costs. Massachusetts residents can benefit from the SMART program, offering fixed-rate payments for solar generation over 10 years.

To qualify for state incentives, you typically need to:

– Work with a certified installer

– Install equipment that meets state-specific requirements

– Submit necessary documentation within required timeframes

– Own the property where the system is installed

– Meet income requirements (for certain programs)

Many states also offer property tax exemptions for renewable energy installations, ensuring your property taxes won’t increase despite the added home value. Solar Renewable Energy Credits (SRECs) are available in several states, allowing you to earn money by selling credits for the clean energy your system produces.

Contact your state’s energy office or visit their website to learn about available programs. Local utilities often provide additional incentives, so check with your power company as well. Remember that state incentives can change annually, so it’s important to verify current offerings before starting your project.

Utility Company Programs

Many utility companies across the country offer their own incentive programs to encourage homeowners to adopt green energy solutions. These programs often complement federal and state initiatives, creating additional opportunities for savings. One of the most popular utility incentives is net metering, which allows homeowners with solar panels to sell excess electricity back to the grid, effectively running their meters backward and reducing their monthly bills.

Local utilities frequently provide rebates for energy-efficient home improvements, including solar panel installation, smart thermostats, and energy-efficient appliances. These rebates can range from $100 to several thousand dollars, depending on the program and your location. Some utilities also offer special time-of-use rates that help you maximize peak electricity savings by adjusting your energy consumption patterns.

Many power companies provide free energy audits to help homeowners identify areas where they can improve efficiency and qualify for additional incentives. Some utilities even offer on-bill financing, allowing customers to pay for green energy improvements through their monthly utility bills, often at reduced interest rates.

To find available utility programs in your area, start by visiting your local utility company’s website or calling their customer service department. Many utilities have dedicated “green energy” or “sustainability” sections on their websites that detail current offers. Remember that these programs often have limited funding and may change annually, so it’s worth checking regularly for new opportunities to save.

How to Claim Your Green Energy Incentives

Required Documentation

To claim your green energy incentives, you’ll need to prepare several key documents. Start with proof of purchase and installation, including detailed receipts and contracts from your contractor. These should clearly show the total system cost, installation date, and equipment specifications.

You’ll also need a completed IRS Form 5695 for residential energy credits when filing your taxes. Keep copies of your most recent utility bills and your property deed or lease agreement to verify your residence ownership status.

For solar installations, gather your interconnection agreement with your utility company and any local building permits. Many incentive programs require certification that your system meets specific energy efficiency standards, so maintain documentation from your installer confirming these requirements.

Photos of your installation, both during and after completion, are often required. These should clearly show the equipment placement and major components. Have your contractor provide a technical specification sheet detailing system capacity and expected performance metrics.

Make digital copies of all documents and organize them in a dedicated folder. Most incentive programs allow online submission, but keep physical copies for your records. Remember that state-specific programs may require additional documentation, so check with your local energy office for any region-specific requirements.

Remember to retain all documentation for at least five years after receiving your incentives, as some programs conduct periodic audits to ensure compliance.

Timeline and Important Deadlines

The federal solar tax credit remains available through 2034, offering a 30% deduction for installations completed between 2022 and 2032. This percentage will decrease to 26% in 2033 and 22% in 2034. To qualify for current rates, systems must be installed and operational by December 31st of the claiming year.

State-level incentives typically operate on fiscal-year cycles (July 1 – June 30), with many programs accepting applications year-round until funds are depleted. It’s recommended to apply early in the fiscal year when funding pools are freshest.

Most utility rebate programs process applications within 4-6 weeks. Solar installation permits generally take 2-8 weeks for approval, depending on your locality. Once approved, installation typically requires 1-3 days, with utility interconnection taking an additional 2-4 weeks.

For tax credits, documentation must be submitted with your annual tax return, due April 15th of the year following installation. Keep all receipts, contracts, and certification documents for at least three years after claiming incentives.

Remember that some incentive programs have limited funding and operate on a first-come, first-served basis. Many states require pre-approval before installation begins, with processing times ranging from 2-12 weeks. Equipment must usually meet specific energy efficiency standards and be installed by certified professionals to qualify.

Maximizing Your Solar Investment

To maximize your solar investment, it’s essential to take a strategic approach that combines multiple incentives and optimization techniques. Start by thoroughly researching all available federal, state, and local incentives. Many homeowners overlook local utility rebates or state-specific tax credits that can be claimed alongside the federal solar tax credit, potentially saving thousands more.

Consider timing your solar installation strategically. Some incentives have declining rates over time, while others might have limited funding. Installing your system before major incentive reductions can significantly impact your overall savings. Additionally, many utilities offer time-of-use rates that can be leveraged with solar panels and battery storage to maximize your return on investment.

Implementing smart home energy management systems can further enhance your solar benefits. These systems help optimize energy consumption by automatically adjusting usage patterns to maximize solar power utilization and minimize grid electricity purchases during peak rate periods.

Consider complementing your solar installation with energy-efficient home design improvements. Simple upgrades like LED lighting, improved insulation, and energy-efficient appliances can reduce your overall energy needs, allowing your solar system to cover a larger percentage of your consumption.

Don’t forget to maintain detailed records of all expenses and improvements. These documents are crucial for claiming tax incentives and rebates. Many incentive programs require specific documentation, and having organized records ensures you won’t miss out on any benefits. Consider working with a qualified tax professional who understands renewable energy incentives to maximize your tax advantages and ensure compliance with program requirements.

Finally, explore community solar programs or group-buying initiatives in your area. These programs often provide additional discounts through bulk purchasing power and may offer unique incentives not available to individual buyers.

Government incentives for green energy represent a golden opportunity for homeowners to make a positive impact on both the environment and their finances. These programs make sustainable energy solutions more accessible than ever before, offering substantial savings through tax credits, rebates, and grants that can significantly reduce initial installation costs and provide ongoing benefits.

By taking advantage of these incentives, you’re not just reducing your carbon footprint – you’re making a smart financial investment in your property’s future. Solar panels, energy-efficient appliances, and other green technologies can dramatically lower your monthly utility bills while increasing your home’s value. The combination of federal, state, and local incentives often means the actual cost of going green is far less than many people realize.

The time to act is now. Many of these incentives are time-sensitive, with some programs offering the most generous benefits to early adopters. By starting your green energy journey today, you can secure the best available incentives while contributing to a more sustainable future. Remember, every step toward renewable energy, no matter how small, makes a difference.

Don’t let these opportunities pass you by. Research the incentives available in your area, consult with qualified professionals, and take advantage of these programs to make your home more energy-efficient and environmentally friendly. The investment you make today in green energy will pay dividends for years to come, both for your wallet and our planet.